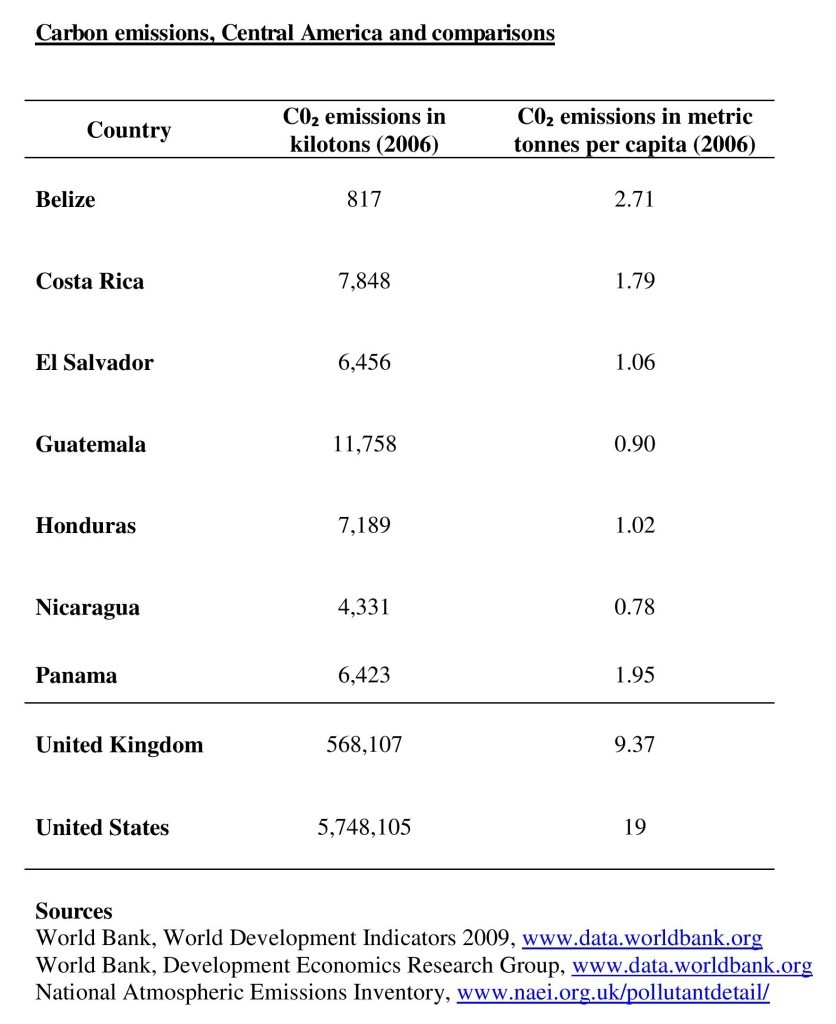

This figure is referred to in the book as Box 6.1 (Page 116)

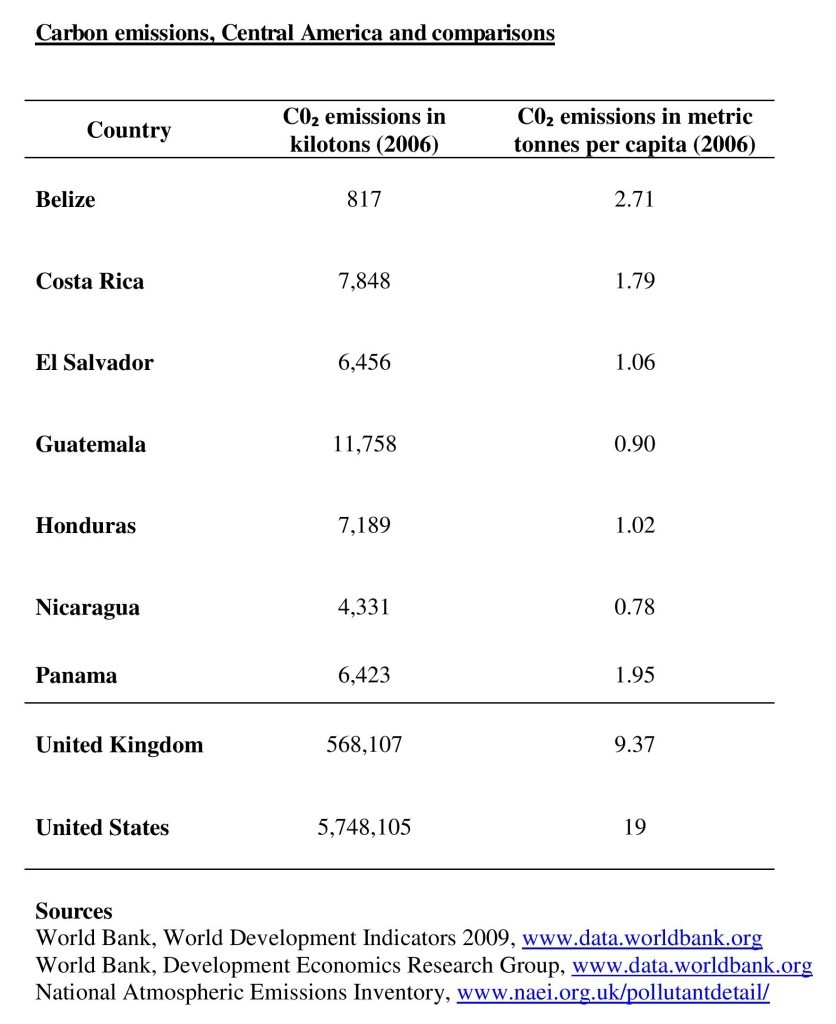

This figure is referred to in the book as Box 6.1 (Page 116)

The first acquisition of carbon credits from a forestry offset project was a trade between the World Bank Group and a reforestation project in Costa Rica owned by the Swiss group Precious Woods in 2006. The World Bank claims that it managed to counteract 100 per cent of its greenhouse gas (GHG) emissions, equivalent to 22,000 megatons of CO2, produced by its Washington D.C. headquarters.[1]

Over the last 20 years, the Ministry of the Environment, Energy and Telecommunications (MINAET) in Costa Rica claims that the country has expanded the area of forested land from 21 per cent to 51 per cent.[2] The country aims to be the first to achieve carbon neutrality by the year 2021. A study conducted by Yale University, however, finds this target to be very ambitious due to inaccuracies in government calculation and prediction.[3] Currently Costa Rica emits 12 megatons of CO2 per year with 75 per cent of this due to transportation.[4] Trends in Costa Rica’s development over the past few decades suggest that the country will produce more CO2 in 2021 than it can compensate for (16 megatons per year). This is because the demand on land for agriculture and residential purposes means that only a further 11 per cent of surface area is available for reforestation and this is not enough to sequester the predicted rise in emissions.[5] The Yale study suggests that to reach carbon neutrality, Costa Rica would need to reduce emissions directly by increasing usage of public transport and electric or hybrid cars, better urban planning and a more efficient energy sector.[6]

[1] Steven Ruddell, Michael Walsh and Murali Kanakasabai (2006) ‘Forest trading and marketing in the United States’, Society of American Foresters (SAF), www.ecosystemmarketplace.com/pages/dynamic/resources.library.page.php?page_id=4848§ion=home&eod=1 (accessed 11 January 2011).

[2] Mike McDonald (18 September 2009) ‘Carbon neutrality is a stiff challenge’, Tico Times, San José.

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] Ibid.

An example of a sequestration project commissioned by the American company, Applied Energy Service (AES), in partnership with the NGO CARE, demonstrates the negative effects of agroforestry on the inhabitants of western Guatemala.[1] The project was planned to sequester 15 -16 million tons of CO2 in 40 years, but is massively failing to offset carbon at this rate, and has only counterbalanced the equivalent of 270,000 tons of CO2 in 10 years.[2] (The AES company also features in Chapter 4 for its destructive Chan 75 hydroelectric project in Panama.)

The first mistake was that the species of tree planted were inappropriate for the climate and for the already degraded land, so the plantation did not mature as rapidly as anticipated. Other reasons for the project’s failure can be attributed to land use conflicts, disputes over control for scarce forest, and legal changes that criminalised subsistence activities such as fuel wood collection and denied farmers access to the forest.[3] These riled locals enough for them to sabotage the planted trees, and this, along with damage caused by animals, also halts expansion. Because the project is underachieving, more resources are being used on carbon measuring than poverty alleviation in the area[4], yielding absolutely no benefit for the people of Guatemala.

[1] Chris Lang (9 October 2009) ‘How a forestry offset project in Guatemala allowed emissions in the USA to increase’, www.redd-monitor.org/2009/10/09/how-a-forestry-offset-project-in-guatemala-allowed-emissions-in-the-usa-to-increase/ (accessed 11 January 2011).

[2] Ibid.

[3] Ibid.

[4] Ibid.

The Copenhagen Climate conference in 2009 established that between the years of 1990 and 2008, Honduras was the third worst affected country in the world by global climate change.[1] The Inter-Governmental Panel on Climate Change (IPCC) implies that this was due to augmented incidences of major hurricanes, torrential rains and flooding, heat waves, droughts, loss of soil productivity and rising sea levels, plus increased intensity of the El Niño and La Niña phenomena. Yet in 2005, Honduras proudly proclaimed itself to be the first country in the world to voluntarily comply with the Kyoto Protocol’s guidelines[2] because their emissions of greenhouse gases were 5 per cent lower than 1990 levels.[3]

In 2005 the Executive Board of the Clean Development Mechanism (CDM) issued the first ever certified emission reductions (CERs). These were awarded for two hydroelectric projects in Honduras. La Esperanza Hydroelectric Project is expected initially to generate 37,000 CERs annually and is registered in partnership with Italy, while the Rio Blanco Small Hydroelectric Project, in which Finland has a stake, produces 17,800 CERs per year.[4]

La Esperanza is a small containment and runoff facility located in the department of Intibucá. The project was developed by a Honduran company Consorcio de Inversiones SA de CV (CISA) and commercial operation began in 2006. CISA claim to have assisted the community by:

The carbon offsets yielded by La Esperanza have been sold to the International Bank for Reconstruction and Development (IBRD), one of the five institutions that comprise the World Bank Group.[5] The Community Development Carbon Fund (CDCF), also a stem of the World Bank, strongly supports La Esperanza as it promotes a co-benefits approach to climate change by linking carbon finance to tangible poverty reduction and sustainable development outcomes.[6]

[1] Visión de País 2010-2038 (August 2010) ‘Honduras, el primer país en cumplir de forma voluntaria con el Protocolo de Kioto’, Honduran government news sheet, August 2010.

[2] Ibid.

[3] Ibid.

[4] UNFCCC (20 October 2005) ‘First emission credits issued under the Kyoto Protocol’, http://cdm.unfccc.int/CDMNews/issues/issues/I_WJHSF1N67JGAORWII2BKVAI8O74B5A/viewnewsitem.html (accessed 11 January 2011).

[5] www.laesperanza-hydro.com/carbon.htm (accessed 11 January 2011).

[6] Aditi Sen (June 2009) ‘The Community Development Carbon Fund (CDCF): Assessment of Community Benefits and Sustainable Development’, World Bank, siteresources.worldbank.org/…/CDCF_paper_final_with_cover.pdf

Increasing allegations of corruption and profiteering are raising serious questions about the UN-run carbon trading mechanism aimed at cutting pollution and rewarding clean technologies

By Patrick McCully* | Originally published in the UK Guardian | Date: Wednesday, May 21, 2008

The world’s biggest carbon offset market, the Kyoto Protocol’s clean development mechanism (CDM), is run by the UN, and is intended to reduce emissions by rewarding developing countries that invest in clean technologies. In fact, evidence is accumulating that it is increasing greenhouse gas emissions behind the guise of promoting sustainable development. The misguided mechanism is handing out billions of dollars to chemical, coal and oil corporations and the developers of destructive dams – in many cases for projects they would have built anyway.

According to David Victor, a leading carbon trading analyst at Stanford University in the US, as many as two-thirds of the supposed “emission reduction” credits being produced by the CDM from projects in developing countries are not backed by real reductions in pollution. Those pollution cuts that have been generated by the CDM, he argues, have often been achieved at a stunningly high cost: billions of pounds could have been saved by cutting the emissions through international funds, rather than through the CDM’s supposedly efficient market mechanism.

And when a CDM credit does represent an “emission reduction”, there is no global benefit because offsetting is a “zero sum” game. If a Chinese mine cuts its methane emissions under the CDM, there will be no global climate benefit because the polluter that buys the offset avoids the obligation to reduce its own emissions.

A CDM credit is known as a certified emission reduction (CER), and is supposed to represent one tonne of carbon dioxide not emitted to the atmosphere. Industrialised countries’ governments buy the CERs and use them to prove to the UN that they have met their obligations under Kyoto to “reduce” their emissions. Companies can also buy CERs to comply with national-level legislation or with the EU’s emissions trading scheme. Analysts estimate that two-thirds of the emission reduction obligations of the key developed countries that ratified Kyoto may be met through buying offsets rather than by decarbonising their economies.

Almost all the demand for CERs has so far come from Europe and Japan. In the next few years, Australia and Canada could become significant CER buyers. In the longer term, the US could become the largest single market for CDM offsets under legislation being debated. The climate plan by Republican presidential hopeful John McCain would allow supposed emission reductions in the US to be met through domestic and CDM offsets.

Around 2bn CERs are expected to be generated by the end of this phase of Kyoto in 2012. At their current price, project developers will sell around £18bn-worth of CDM credits over the next five years. The CDM approved its 1,000th project on April 15. More than twice as many are making their way through the approvals process.

Marginal improvement

Any type of technology other than nuclear power can apply for credits. Even new coal plants, if these can be shown to be even a marginal improvement upon existing plants, can receive offset income. A massive 4,000MW coal plant on the coast of Gujarat, India, is expected soon to apply for CERs. The plant will spew into the atmosphere 26m tonnes of CO2 per year for at least 25 years. It will be India’s third – and the world’s 16th – largest source of CO2 emissions.

Many observers had hoped that the CDM would promote renewables and energy efficiency. Yet if all projects now in the pipeline generated the CERs they are claiming up to 2012, non-hydro renewables would attract only 16% of CDM funds, and demand-side energy efficiency projects just 1%. Only 16 solar power projects – less than 0.5% of the project pipeline – have applied for CDM approval.

For a project to be eligible to sell offsets, it is supposed to prove that it is “additional”. “Additionality” is key to the design of the CDM. If projects would happen anyway, regardless of CDM benefits, then their offsets would not represent any reduction in emissions.

But judging additionality has turned out to be unknowable and unworkable. It can never be definitively proved that if a developer or factory owner did not get offset income they would not build their project or switch to a cleaner fuel supply- and would not do so over the decade for which projects can sell offsets.

The documents written by carbon consultants to justify why their clients’ projects should be approved for CDM offsets contain enough lies to make a sub-prime mortgage pusher blush. One commonly used “scam” is to make a proposed project look like an economic loser on its own, but a profitable earner once offset income is factored in. Examples include the Indian wind developers who failed to tell the CDM about the lucrative tax credits their projects were earning.

Off-the-record, industry insiders will admit that deceitful claims in CDM applications are standard practice. The carbon trading industry lobby group, the International Emissions Trading Association (IETA), has stated that proving the intent of developers applying for the CDM “is an almost impossible task”. Industry representatives have complained that “good storytellers” can get a project approved, “while bad storytellers may fail even if the project is really additional”.

One glaring signal that many of the projects being approved by the CDM’s executive board are non-additional is that almost three-quarters of projects were already complete at the time of approval. It would seem clear that a project that is already built cannot need extra income in order to be built.

Michael Wara, a law professor and carbon trade analyst from Stanford University, and Victor show in a recent paper that “essentially all” new hydro, wind and natural gas fired projects being built in China are now applying for CDM offsets. If the developers are being truthful that their projects are additional, this implies that without the CDM virtually no hydro, wind or gas projects would be under construction in China. Given the boom in construction of power projects in China, the fact that it is government policy to promote these project types, and the fact that thousands of hydro projects have been built in China without any help from the CDM, this is simply not credible.

Additionality also creates perverse incentives for developing country governments not to bring in, or enforce, climate-friendly legislation. Why should a government voluntarily act to cap methane from its landfills or encourage energy efficiency if in doing so it makes these activities “business-as-usual”, and so not additional and not eligible for CDM income?

Waste gases

The project type slated to generate the most CERs is the destruction of a gas called trifluoromethane, or HFC-23, one of the most potent greenhouse gases, and a waste product from the manufacture of a refrigerant gas. Every molecule of HFC-23 causes 11,700 times more global warming than that of CO2. Because of this massive “global warming potential”, chemical companies can earn almost twice as much from selling CERs as from selling refrigerant gases. This has spurred concern that refrigerant producers may be increasing their output solely so that they can produce, and then destroy, more waste gases.

A rapidly growing industry of carbon brokers and consultants is lobbying for the CDM to be expanded and its rules to be weakened further. If we want to sustain public support for effective global action on climate change, we cannot risk one of its central planks being a programme that is so fundamentally flawed. In the short term, the CDM must be radically reformed. In the long term it must be replaced.

* Patrick McCully is the former executive director of International Rivers and is now executive director of Blackrock Solar which provides not-for-profit entities, tribes and underserved communities with access to clean energy, education, and job training.